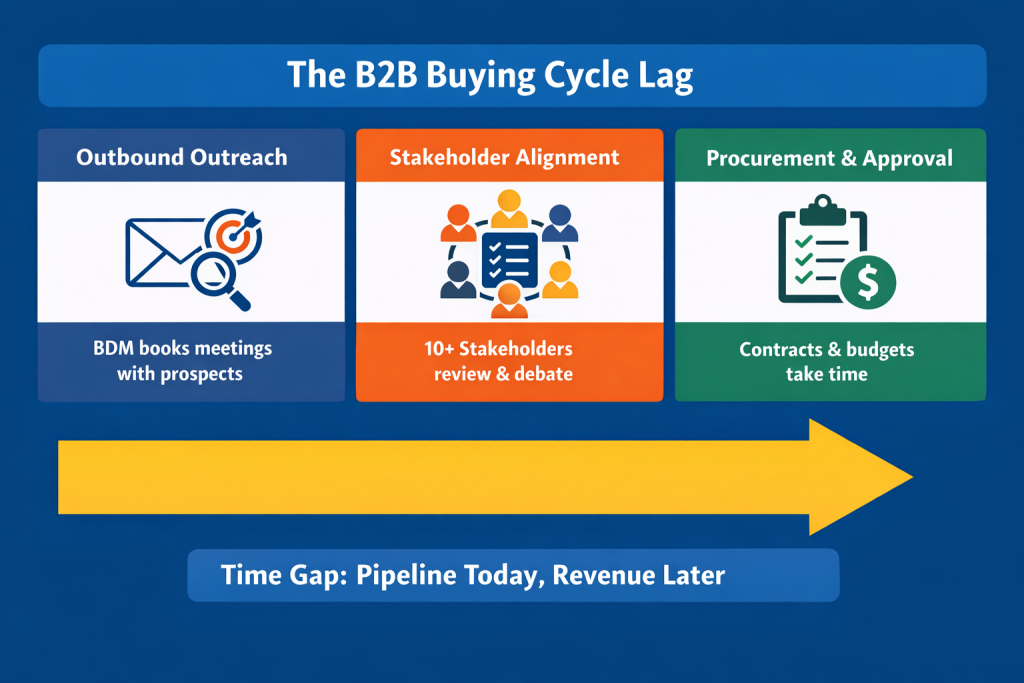

Revenue rarely shows up in the same month that business development work starts. A remote Business Development Manager (BDM) can run a disciplined outbound motion, book strong meetings, and still report zero closed revenue inside a 30-day window. That lag does not signal failure. It reflects how B2B buying committees evaluate risk, align stakeholders, and move through procurement. A serious ROI model treats pipeline as a financial asset that matures over time and produces cash later.

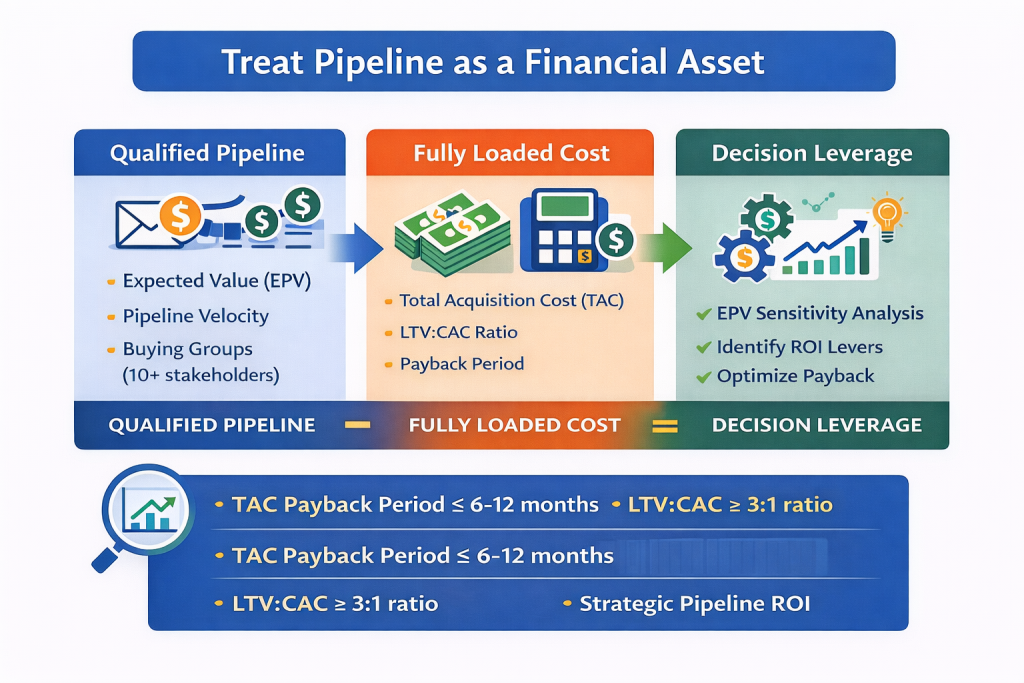

B2B decisions now happen inside buying groups, not inside one decision-maker’s head. Multiple stakeholders slow decisions, introduce new objections, and stretch cycle length. Corporate Visions cites 6sense data that shows buying groups often include around 10 to 11 stakeholders on average. That reality changes how leaders should evaluate business development. A credible model measures qualified pipeline creation, pipeline velocity, and cash timing, then connects those outputs to unit economics.

The ROI model that does not lie

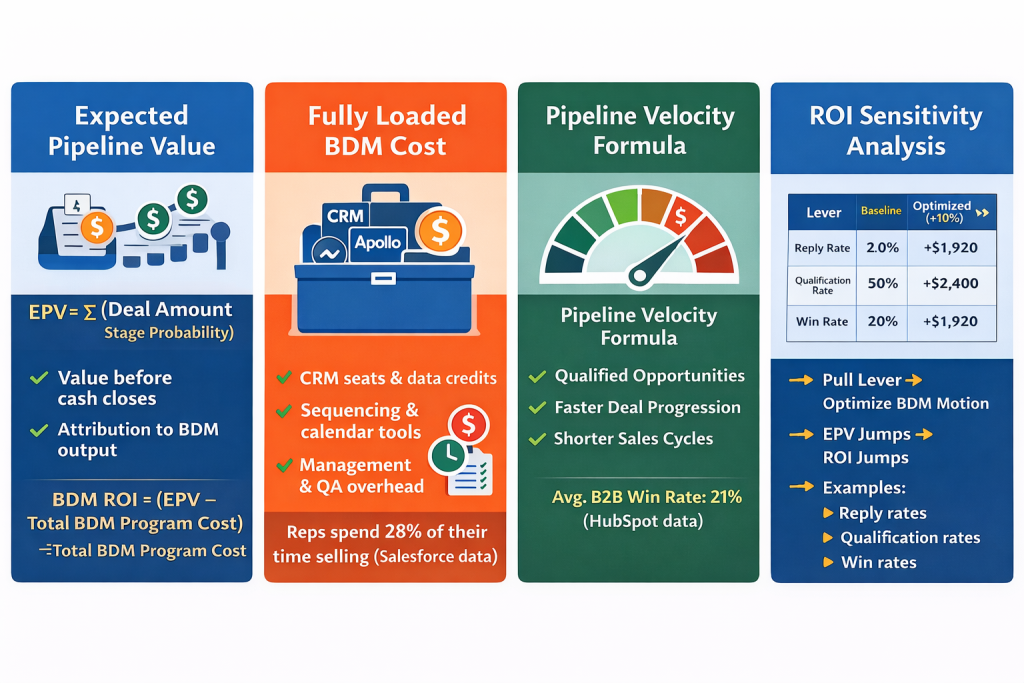

Start with expected value of pipeline because expected value lets you measure performance before cash closes. Closed revenue depends on pricing, delivery, product-market fit, and the closer’s execution. Those variables matter, but they do not isolate the BDM’s contribution. Expected value keeps your measurement aligned with what the BDM controls: opportunity creation quality, qualification integrity, and deal progression.

Use a simple framework that finance teams respect. Calculate Expected Pipeline Value (EPV) using stage probability, then compute ROI against fully loaded cost. Stage probability should come from your historical conversion rates, not gut feel. That discipline forces clean CRM stages and prevents “happy ears” forecasting.

Expected Pipeline Value (EPV) = Σ (Deal Amount × Stage Probability)

BDM ROI = (EPV attributable to the BDM − Total BDM Program Cost) ÷ Total BDM Program Cost

This model removes emotion from the conversation. It turns pipeline into a quantified asset. It also creates a shared language between sales leadership and finance. When your teams agree on stage definitions and probability, forecasting improves and budget decisions become easier.

Cost it like a CFO: include the full stack, not just the fee

Many ROI debates collapse because teams undercount costs. Finance does not care about optimism. Finance cares about fully loaded cost. Count CRM seats, LinkedIn Sales Navigator, Apollo or ZoomInfo credits, sequencing software, enrichment tools, calendar tools, and call recording if you use it. Include management time for coaching, QA, and deal hygiene because that time carries opportunity cost.

Salesforce puts a hard number on why this matters. Salesforce reports that sales reps often spend only 28% of their week actually selling, which means admin work consumes the majority of capacity. That stat changes the ROI conversation. When a remote BDM runs prospecting, follow-up, and qualification with discipline, closers recover time for discovery, proposals, negotiation, and expansion. That recovered capacity holds real value because it influences how much revenue your team can close per unit of cost.

Opportunity cost belongs inside the model. Every hour spent on non-selling work has a “next best use.” If a founder spends six hours per week doing prospect research, the business loses strategic time and still fails to build a repeatable pipeline engine. If an AE spends half a day cleaning lists and updating fields, the business pays in quota shortfall. A strong remote BDM program shifts that lost time back into revenue work.

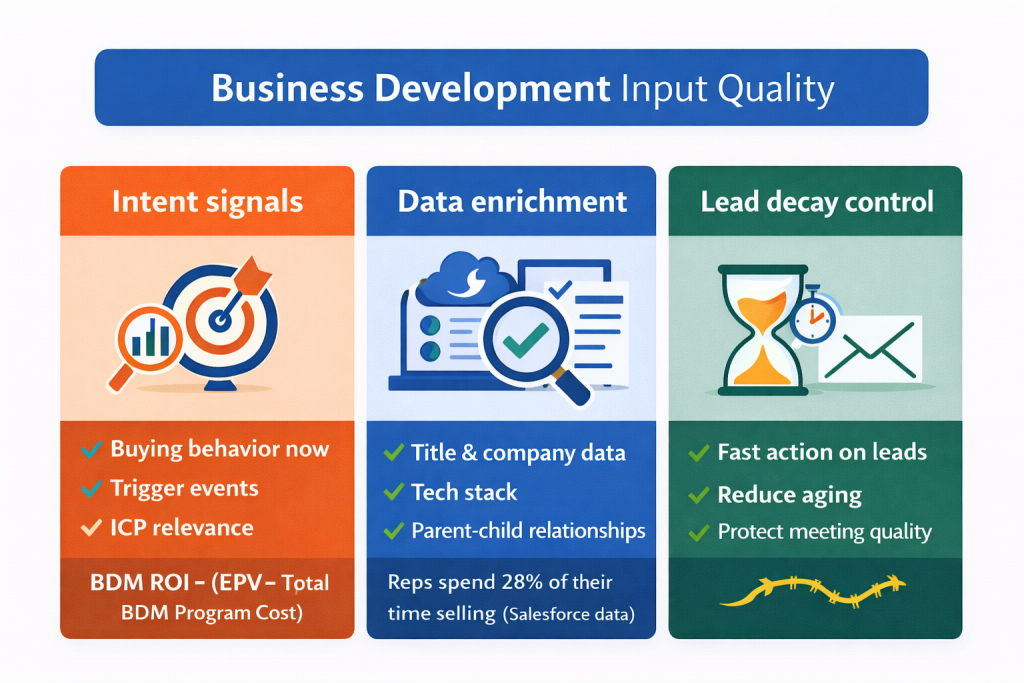

The performance inputs that actually move ROI

A remote BDM’s ROI does not come from sending more messages. ROI comes from input quality that holds up under scrutiny. Three inputs dominate: intent signals, data enrichment, and lead decay control. Intent signals tell you which accounts show buying behavior now. Data enrichment improves targeting precision and personalization relevance. Lead decay control reduces the time between signal and outreach, which protects reply rate and meeting quality.

This is where most outbound programs fail. Teams buy tools, scrape broad lists, and send generic sequences. Then they blame the channel. A better lens asks: did the BDM build lists using firmographic fit, trigger events, and buyer-role alignment? Did the BDM use enrichment to validate titles, tech stack, location, and parent company relationships? Did the BDM act fast when intent signals appeared, or did the lead sit for two weeks while competitors moved?

Reply-rate benchmarks show why small input improvements matter. Many reports put cold email reply rates in the low single digits for typical senders. That range punishes sloppy targeting and rewards relevance. A one-point improvement in reply rate can cascade into meaningful pipeline changes when your BDM runs consistent volume. A CFO-grade model tracks these inputs so leadership can invest in the lever that drives ROI instead of blaming the person running the process.

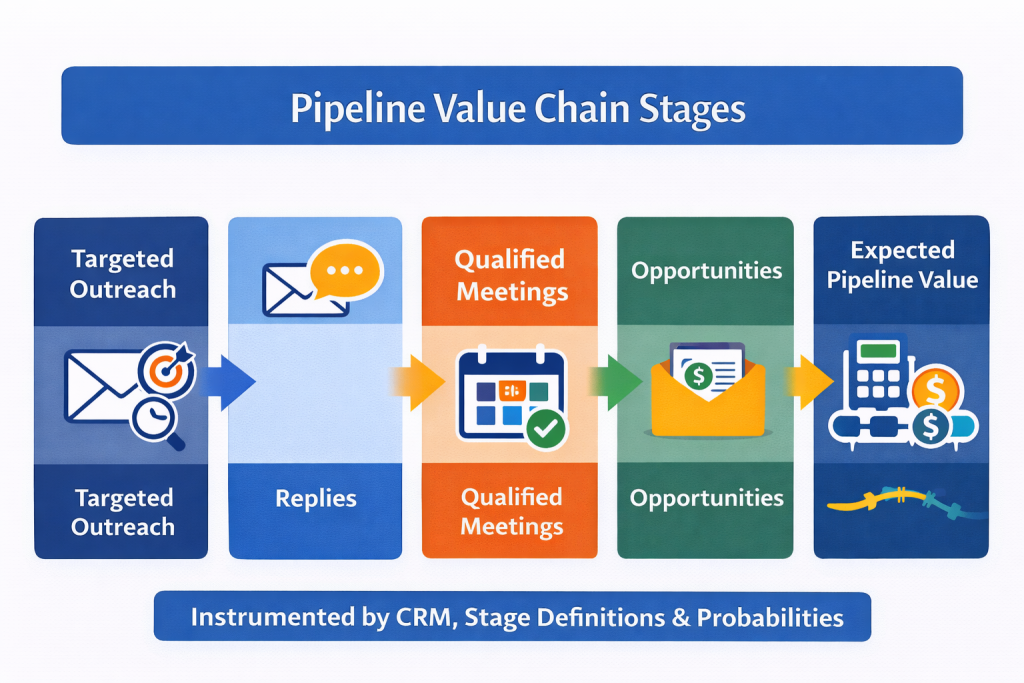

Replace vanity metrics with a BDM value chain

A clean ROI system tracks a short value chain with strict definitions. Track targeting accuracy, positive reply rate, meeting set rate, qualified meeting rate, opportunity creation rate, pipeline created, and pipeline velocity. Do not treat open rate as a decision metric because privacy changes and bot filtering distort it. Do not celebrate meetings booked without qualification because bad meetings waste expensive selling time.

Define qualification with fit and intent. Fit includes firmographics, industry, company size, geography, and technical compatibility. Intent includes urgency signals, budget reality, active initiatives, and stakeholder involvement. These definitions protect your time and protect forecast integrity. A remote BDM can book many meetings by lowering the bar, but that behavior destroys ROI because it shifts cost onto your closers.

Pipeline velocity ties everything together. Velocity is not a buzzword. It measures how quickly pipeline converts into cash. Velocity increases when qualification improves, when deals move through stages faster, and when win rate increases through better account selection. Buying groups often include around 10 to 11 stakeholders, which stretches cycle length unless the team manages stakeholder alignment with process. A remote BDM can support that work by documenting stakeholders, capturing risk signals early, and confirming next steps with clarity.

Add finance entities: LTV:CAC, payback period, and unit economics

CFOs do not ask, “Did we get meetings?” CFOs ask, “Did this improve unit economics?” Your ROI model should connect pipeline to LTV:CAC, CAC payback period, and contribution margin. When a remote BDM creates qualified pipeline that converts, CAC drops because the same sales team closes more revenue per unit of cost. Payback improves when pipeline velocity improves because cash arrives sooner. Contribution margin improves when the team reduces wasted selling time and focuses on higher-fit opportunities.

A practical model connects these entities directly. Treat the remote BDM program as part of customer acquisition cost. Then measure whether the incremental pipeline created from that program improves LTV:CAC and reduces payback. If your business sells subscription revenue, use gross margin adjusted LTV to stay honest. If you sell services, use contract value and renewal rate to compute a conservative lifetime estimate. A serious model uses conservative assumptions and still shows a clear story.

A worked example that proves the lag through math

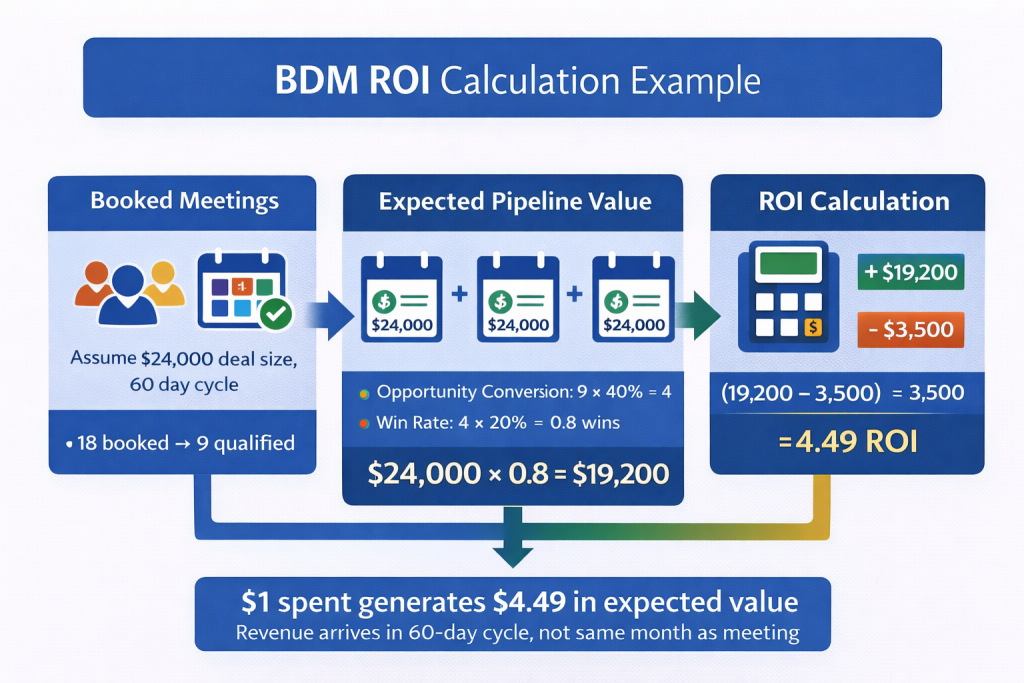

Assume a B2B services company sells $24,000 annual contracts and runs a 60-day sales cycle. The company pays $3,500 per month for a remote BDM program including tools, data, and management overhead. The BDM books 18 meetings in a month and qualifies 50% of them, so 9 qualify. The company converts 40% of qualified meetings into opportunities, so it creates 4 opportunities.

Now compute expected value. If each opportunity carries $24,000 ACV and historical win rate sits at 20%, expected revenue equals $24,000 × 4 × 0.20 = $19,200 in expected pipeline value. ROI equals ($19,200 − $3,500) ÷ $3,500 = 4.49. That means the company creates $4.49 in expected value per $1 spent. Cash will arrive later because the cycle length is 60 days, but the financial outcome already exists in the pipeline asset.

This example also creates operational clarity. Leaders can see exactly where ROI comes from. The model shows leverage points: meeting quality, qualification rate, opportunity conversion, and win rate. It also shows what not to do: chasing more volume without improving fit. Volume without relevance increases cost and can damage sender reputation, which eventually reduces results and increases CAC.

Sensitivity analysis: identify the leverage points

Finance teams love sensitivity analysis because it exposes leverage points. Outbound economics behave like a multiplier stack. A small improvement early in the funnel cascades into meaningful EPV gains later. Sensitivity analysis turns that insight into a decision tool.

Here is a simple sensitivity view using the example above, holding cost constant at $3,500 per month:

Lever: Reply rate (drives meetings)

Baseline: 2.0%

Optimized (+10%): 2.2%

Impact on Monthly EPV: +$1,920

Reason: More qualified conversations enter the funnel.

Lever: Qualification rate

Baseline: 50%

Optimized (+10%): 55%

Impact on Monthly EPV: +$2,400

Reason: Less wasted closer time, higher opportunity quality.

Lever: Opportunity conversion

Baseline: 40%

Optimized (+10%): 44%

Impact on Monthly EPV: +$2,112

Reason: Stronger discovery discipline and clearer next steps.

Lever: Win rate

Baseline: 20%

Optimized (+10%): 22%

Impact on Monthly EPV: +$1,920

Reason: Better fit selection and stronger stakeholder alignment.

Lever: Sales cycle length

Baseline: 60 days

Optimized (+10%): 54 days

Impact: Faster cash timing

Reason: Improved payback period and planning confidence.

This table reveals a key truth. ROI rarely depends on one metric. ROI depends on the lever that the team can improve fastest without increasing cost. A remote business development manager can often lift reply rate and qualification rate through better enrichment, tighter ICP filters, better sequencing discipline, and better follow-up. Those improvements compound into EPV and shorten payback.

The operational system that keeps ROI real

The model only works when the process stays disciplined. The CRM must enforce stage definitions, exit criteria, and probability logic. The team must log activities and outcomes consistently. The BDM must document stakeholder context, key objections, and next steps, then hand that information to the closer in a clean format. When that system runs properly, pipeline becomes measurable and forecastable.

Leadership must also set realistic expectations around ramp. A remote BDM does not walk into a company and perform at full speed on day one. The team needs messaging clarity, offer clarity, ICP clarity, tool access, and a clean list-building process. When leadership treats onboarding as enablement instead of “figure it out,” performance stabilizes faster and the ROI model becomes trustworthy sooner.

Final verdict: treat pipeline as a financial asset, then manage it like one

A remote BDM can produce predictable ROI when leadership measures the right entity: qualified pipeline value that moves. The EPV-based model aligns with how finance evaluates forecast risk. The cost model respects fully loaded inputs and opportunity cost. The value chain protects quality and prevents vanity reporting. Sensitivity analysis shows leverage points so leaders can improve ROI through targeted changes instead of reactive hiring decisions.

To see the full role scope, responsibilities, and hiring model, review our Remote Business Development Manager service page.