Most teams compare a remote accountant vs in-house accountant by salary.

That comparison misses the real expense: unreliable numbers. Late month-end close slows decisions, hides cash risk, and turns taxes into a fire drill.

Compare options by Total Cost of Ownership (TCO) and cost per reliable month-end close. You want financial integrity you can run a business on.

Key Takeaways

- Salary never captures total cost. TCO includes benefits, hiring time, software, and rework.

- Output beats hours. Track close speed, reconciliation coverage, and reporting quality.

- A remote finance professional can deliver controller-grade discipline without full in-house overhead.

- A strong model clarifies roles: bookkeeper handles transactions, finance professional owns close, CPA handles tax filing.

- Aim for an 8–10 day close in most SMBs, then improve month by month with a calendar and owners.

- Use a scorecard before you hire, then enforce monthly deliverables.

Why this matters now

Late books create real business damage. You postpone hires because you cannot trust burn rate. You delay pricing changes because gross margin looks “off.” You miss cash risks because A/R aging never gets reviewed in a rhythm.

Tax compliance also suffers. When the general ledger drifts, your CPA spends time fixing coding, chasing documentation, and recreating support schedules. You pay for cleanup instead of strategy.

The fix starts with a decision framework that treats accounting like an operating system, not a set of tasks.

Total Cost of Ownership (TCO) comparison

A useful TCO model answers one question: what does one full year of reliable close output cost?

TCO includes more than pay

In-house hire usually includes:

- Base salary

- Employer payroll taxes and legally required benefits

- Benefits and paid leave

- Recruiting costs and time

- Onboarding time for your team

- Management time and quality review time

- Turnover risk and coverage gaps

Remote hire often includes:

- Monthly fee or hourly cost

- Onboarding time

- Tool access and process integration

- Review cadence and performance tracking

Accounting firm support often includes:

- Retainer or engagement fee

- Limited responsiveness outside scope

- Less day-to-day ownership

Anchor your TCO with real wage and overhead data

The U.S. Bureau of Labor Statistics reports a median annual wage of $81,680 for accountants and auditors (May 2024). That figure helps you model salary expectations, even if your market runs higher.

Employers also pay overhead beyond wages. BLS Employer Costs for Employee Compensation shows benefits account for a meaningful share of employer cost in private industry, with benefits near 29.8% of employer costs in the June 2025 release. That number will vary by country and benefit plans, but it illustrates the “overhead burden” reality.

Think in FTE terms

Use FTE (Full-Time Equivalent) to compare like-for-like:

- Do you need 1.0 FTE of finance operations ownership?

- Or do you need 0.5 FTE plus a CPA for taxes?

When you write the answer down, you avoid over-hiring or under-hiring.

The output-first standard

You do not buy “accounting help.” You buy reliable monthly output.

A reliable month-end close produces:

- Reconciled bank and credit card accounts

- Reconciled key balance sheet accounts with supporting schedules

- Correct accruals and prepaids, aligned with GAAP principles when your business requires GAAP reporting

- A financial statement package: P&L, balance sheet, cash flow

- A management reporting pack: KPI dashboard and variance commentary

- Audit-ready documentation that supports every material number

How fast should close run?

A CFO summary of an APQC benchmarking survey reports a median close of 6.4 calendar days, with top performers near 4.8 days and bottom performers at 10+ days. Use those figures as a benchmark, not a promise. Complexity changes everything, but the numbers help you set targets.

For many SMBs, an 8–10 day close target gives you a realistic starting point. Your process will tighten over time when you enforce a calendar and clear owners.

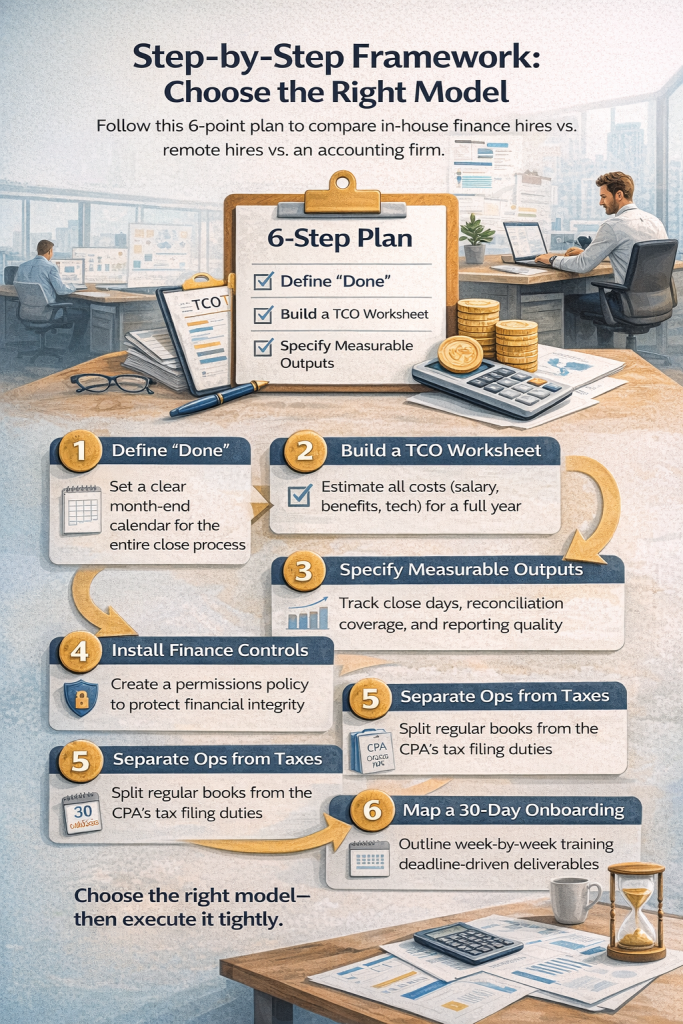

Step-by-step framework: choose the right model

1) Define “done” for month-end close

What to do: Write a one-page close definition with a calendar, owners, and deliverables.

Why it matters: Teams drift when nobody owns cutoffs and reconciliations.

Quick example: “Day 3: bank and card reconciliations complete. Day 6: accruals posted. Day 9: reporting pack delivered with variance notes.”

2) Build a TCO worksheet before you interview anyone

What to do: Model cost in five buckets:

- compensation or monthly fee

- overhead burden (benefits, payroll taxes, equipment)

- recruiting and onboarding time

- software and stack costs

- rework costs from late or inaccurate reporting

Why it matters: Most “cheap” decisions break in buckets 3 and 5.

Quick example: A hire who needs constant review can cost more than a higher-priced resource who ships a clean close pack on time.

3) Specify the outputs you will measure monthly

What to do: Track three output metrics:

- Close speed (days to close)

- Reconciliation coverage (bank, cards, key balance sheet accounts)

- Reporting quality (KPI dashboard plus variance commentary)

Why it matters: Output reveals quality. Activity hides it.

Quick example: A finance professional who closes in 10 days with full reconciliations beats a busy team that never ties out the balance sheet.

4) Install one control model that keeps you safe

This section consolidates the security and access narrative. Use one principle and one checklist, then move on.

Principle: enforce least privilege access. NIST defines least privilege as restricting access “to the minimum necessary to accomplish assigned tasks.”

What to do: Create a permission map and approval flow before you grant access.

Why it matters: Fraud prevention depends on separation of duties, not office location.

Quick example: The finance professional prepares payments and reconciles activity, while the owner approves and releases payments.

Control checklist you can copy:

- Require MFA on accounting systems and email

- Use role-based access control (RBAC) where platforms support it

- Keep banking sign-on and payment authority internal

- Require two-person approval for vendor bank detail changes

- Maintain an exception log for unusual items and late entries

- Store supporting documents in one secure location with an audit trail

5) Separate finance operations from taxes

What to do: Use a clean boundary:

- Finance operations owner keeps books tax-ready

- CPA handles tax filing and tax strategy

Why it matters: That split reduces risk and lowers CPA cleanup time.

Quick example: The finance professional delivers a CPA handoff pack: reconciliations, schedules, fixed asset roll-forward, and year-end journal entry list.

6) Force clarity with a 30-day onboarding plan

What to do: Require week-by-week deliverables:

- Week 1: chart of accounts review, close calendar, backlog map

- Week 2: reconciliations baseline, SOP drafts, exception log starts

- Week 4: first close pack, KPI dashboard, variance notes

Why it matters: Vague onboarding creates vague output.

Quick example: If Week 4 ends without a reconciliation pack, you learned something important early.

Decision guide: what to choose, and when

Choose an in-house accountant when these criteria fit

Pick in-house when you need:

- Constant cross-team coordination every day

- Onsite workflow integration across departments

- A manager who can review journal entries, accruals, and GAAP judgments

- A plan to build a full finance department within 6–12 months

Who benefits most: mid-market operators with stable volume and heavy internal stakeholder needs.

Choose a dedicated remote accountant when you need reliable output fast

Pick a remote finance professional when you need:

- Month-end close ownership and a clear calendar

- Balance sheet integrity and support schedules

- Management reporting that leaders trust

- A lower overhead burden than an in-house 1.0 FTE

- Flexible coverage without turning finance into a single point of failure

Who benefits most: founders, COOs, controller-lite operators, and fractional CFOs who need execution capacity.

Choose an accounting firm when you need scope-bound work

Pick a firm when you need:

- A one-time cleanup

- Audit support

- Tax-only or project-only help

Firms can deliver excellent expertise, but many firms struggle to provide day-to-day finance operations ownership across AP, AR, and close.

Scorecard: remote vs in-house vs firm

Use this table during interviews. Fill it with evidence, not marketing.

| Criteria | In-House Accountant | Dedicated Remote Accountant | Traditional CPA Firm |

|---|---|---|---|

| Close speed ownership | Medium to High (depends on management) | High (SLA-driven deliverables) | Low to Medium (scope-driven) |

| Total overhead burden | High (benefits, payroll taxes, equipment) | Low to Medium (fee-based) | Medium (retainer plus add-ons) |

| Reporting cadence | Medium (varies by maturity) | High (structured pack) | Low (often tax-focused) |

| GAAP discipline | Medium to High (role-dependent) | Medium to High (seniority-dependent) | High (when in scope) |

| Scalability | Medium | High | Medium |

| Coverage risk | High if single hire | Lower with documented SOPs | Medium (capacity constraints) |

How to use it: If you cannot score a category with a concrete deliverable, treat it as a risk.

Risk-reward matrix: common mistakes and fixes

Instead of a long “mistakes” list, use a matrix. Each fix gives you leverage.

| Risk | What it looks like | Fix | What you risk if you ignore it |

|---|---|---|---|

| Overpaying for activity | Long hours, late close | Measure outputs: close days, reconciliations, reporting pack | Permanent “busy finance” with weak integrity |

| Weak internal controls | Vendor changes happen casually | Install approvals, RBAC, exception logs | Fraud exposure and audit pain |

| Balance sheet drift | “Suspense” or “ask my accountant” accounts | Reconcile monthly with support schedules | Tax cleanup bills and wrong decisions |

| Tax season chaos | CPA asks for missing support | Produce CPA handoff pack monthly | Filing delays and penalties in worst cases |

| Tool mismatch | Candidate struggles in your stack | Require QBO/Xero plus AP/expense familiarity | Slow onboarding and inconsistent coding |

A note on SOC 2

When you evaluate vendors or platforms that handle financial data, SOC 2 can help. The AICPA explains that a SOC 2 examination reports on controls relevant to security, availability, processing integrity, confidentiality, or privacy.

Use SOC 2 as a due diligence signal. Do not treat it as a magic shield. Keep your approval workflows and access discipline.

Examples and mini case studies

Case 1: Founder-led services firm, late close and cash surprises

A founder ran decisions off a bank balance because month-end close took three weeks. The team posted transactions inconsistently, and the balance sheet held unsupported accounts.

A dedicated remote finance professional installed a close calendar, cleared the backlog, and rebuilt reconciliations with supporting schedules. They also shipped a monthly close pack with variance notes and a weekly cash snapshot.

The founder gained clean burn rate visibility and stopped guessing at hiring timing.

Case 2: Ecommerce operator, payout reconciliation and taxes

An ecommerce operator saw revenue in Shopify reports, but the bank balance told a different story. Stripe fees, refunds, chargebacks, and marketplace holds distorted the picture. Sales tax tracking stayed inconsistent because the books never tied out cleanly.

A remote accounting resource built a payout reconciliation routine, mapped fees correctly, and stabilized COGS tracking. They delivered a channel-level KPI view that matched cash reality and supported tax reporting.

The operator reduced surprises and regained confidence in margins.

Case 3: Ops-heavy company, finance bottleneck for the COO

A COO needed faster decisions, but finance ran through inbox requests and informal approvals. Vendor details changed without logs, and the team could not trace who approved what.

The company adopted a single access and approvals model, enforced least privilege, and routed payment approvals through a clear workflow. The finance professional then delivered a consistent monthly reporting pack.

The COO regained planning speed without increasing risk.

What does “remote accountant vs in-house accountant” compare?

“Remote accountant vs in-house accountant” compares ownership models. In-house accountant structure enables direct coordination and on-site management. Remote accountant model reduces overhead cost when deliverables and controls are clearly defined.

Can a remote accountant follow GAAP?

Remote accountant can follow GAAP when the role includes sufficient seniority and GAAP compliance is explicitly required. GAAP responsibilities include accrual accounting, prepaid expense tracking, depreciation schedules, and balance sheet consistency.

How fast should month-end close run?

Month-end close should target completion within 8 to 10 days. Benchmark data shows a 6.4-day median, with top performers closing faster and weaker performers exceeding 10 days.

Do I still need a CPA for taxes?

CPA is required for tax filing and tax strategy. Finance operations staff prepare documentation to support tax compliance and reduce CPA cleanup work.

What should I ask in interviews to test quality?

Interview questions to test accounting quality include:

- Sample month-end close checklist

- Reconciliation method for key balance sheet accounts

- 30-day onboarding plan with deliverables

- Variance commentary examples explaining changes and causes

How do I compare costs fairly?

Accounting cost comparison uses total cost of ownership (TCO). TCO includes base salary, overhead burden, recruiting time, and rework risk. Use BLS median wage data as a reference for baseline cost.

Can a remote worker handle accounting and payroll administration?

Remote finance professionals handle accounting and payroll administration, including reconciliations and reporting. Payroll submissions and payment authority must remain with an internal approver or external payroll vendor.

What should I never delegate?

Never delegate payment authority or bank access credentials and to release control internal. Maintain separation of duties, approvals, and an audit trail.

Next step

If month-end close slips past day 10, if taxes create panic, or if you cannot trust the balance sheet, you need a model that delivers financial integrity on a schedule.

Use the scorecard above, then book a free consultation with Aristo Sourcing to map the right level of remote finance support for your tools, workflow, and reporting needs.