A payroll administrator manages the end-to-end execution of employee pay, including tax withholding, statutory deductions, remittance, and secure recordkeeping. They act as the single source of truth for compensation data, so your payroll runs accurately, on time, and with a defensible audit trail.

Most payroll problems start long before payday. They start with weak cutoffs, messy inputs, and uncontrolled access. A payroll administrator tightens the system, not just the calculations.

Key Takeaways

- Payroll administrators own the pay cycle from inputs to payments to closeout.

- They validate time, pay rules, and exceptions before money moves.

- They manage statutory deductions, benefits, and garnishments with clean documentation.

- They coordinate reporting duties where required, such as HMRC RTI submissions in the UK and employee tax certificates like SARS IRP5/IT3(a) in South Africa.

- They reduce penalty risk by enforcing deposit and submission calendars and storing proof.

- They reduce fraud risk with least privilege, MFA, and a Zero Trust mindset for payroll data.

- They cut manual data latency by managing interoperability between time-tracking APIs, HRIS, and payroll engines.

Why this matters now

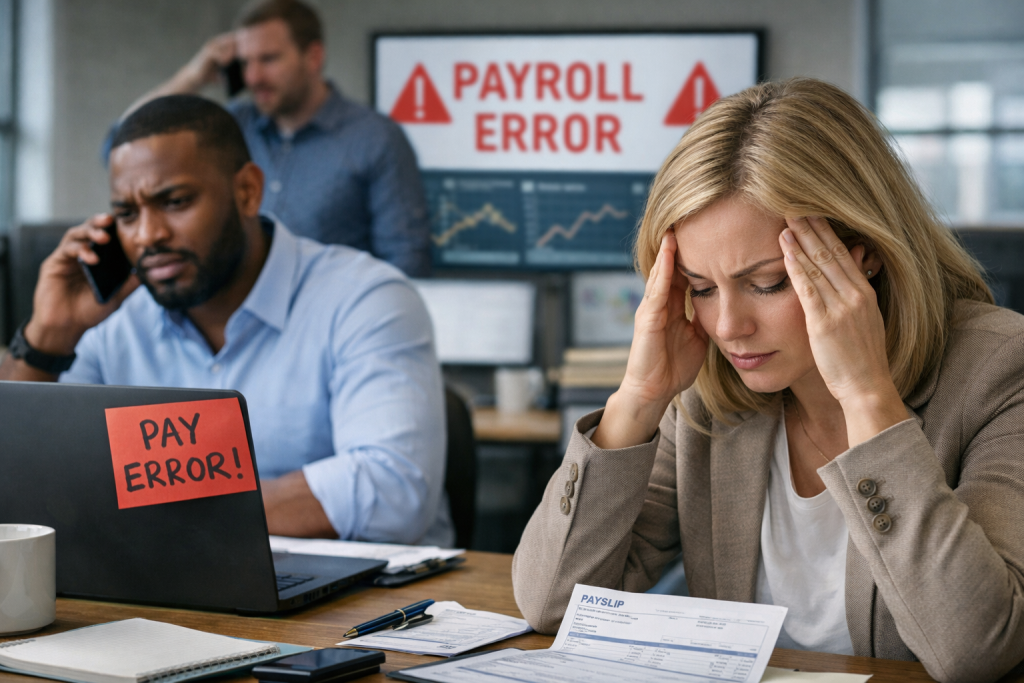

Payroll touches money, privacy, and compliance in one workflow. When payroll breaks, your employees notice first, then finance, then regulators.

Some research found that 53% of employees encountered at least one payroll error.

HiBob reported 64% of employees experienced stress or disruption due to a payroll error.

Software can automate the math. A payroll administrator provides the necessary human-in-the-loop oversight to catch anomalies that software misses, like a suspicious bank change request, an overtime spike that needs verification, or a deduction that started on the wrong effective date.

The core concept explained

A payroll administrator turns “work performed” into “pay delivered” through a controlled process. They run a pipeline with controls at each point.

Payroll fails in predictable places:

- Inputs: timesheets, salary changes, PTO, commissions, expenses, terminations.

- Rules: overtime, statutory deductions, benefit deductions, garnishments, fringe benefits.

- Processing: payroll engine calculations, tax tables, pay registers.

- Payments: direct deposit, pay statements, third-party remittance.

- Closeout: reconciliations, payroll journals, reporting, audit evidence.

A strong payroll administrator treats payroll like finance operations. They manage controls, evidence, and repeatability.

They also manage the “semantic neighborhood” around payroll:

- Compliance: tax withholding, remittance, reporting deadlines, multi-jurisdiction rules.

- Security: access control, audit logs, secure file transfer, identity verification.

- Data: data residency, retention policies, and clean system-of-record discipline.

IBM defines data residency as the physical or geographical location of an organization’s data. That matters when privacy and cross-border rules apply.

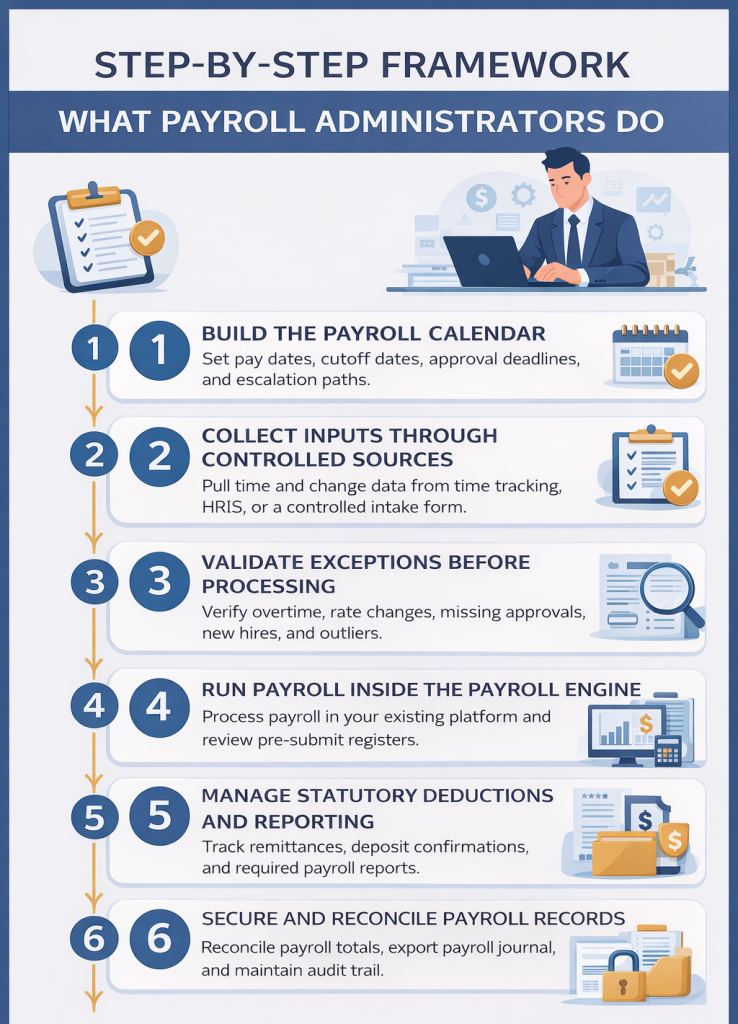

Step-by-step framework: what payroll administrators do

Use this framework as a practical view of payroll administration. You can also use it as a hiring checklist.

1) Build the payroll calendar and enforce cutoffs

What to do: Set pay dates, cutoff dates, approval deadlines, and escalation paths.

Why it matters: Late deposits trigger penalties. The IRS describes failure-to-deposit penalties that increase based on how late deposits run.

Quick example: The admin sets a Tuesday cutoff for timesheets, a Wednesday deadline for approvals, and a locked change window after approvals close.

2) Collect inputs through controlled sources

What to do: Pull time and change data from a source of truth: time tracking, HRIS, or a controlled intake form with approvals.

Why it matters: Loose inputs create repeat errors and a weak audit trail.

Quick example: The admin routes pay changes through a standard request form with an approval field and an effective date.

3) Validate exceptions before processing

What to do: Check overtime, missing approvals, rate changes, negative balances, new hire setup, terminations, and unusual deltas.

Why it matters: Validation prevents the worst kind of payroll work: corrections after payday.

Quick example: The admin flags a spike in hours, confirms eligibility, then logs the approval and reason.

4) Run payroll inside the payroll engine with register discipline

What to do: Process payroll in the system your business already uses, then review the pre-submit register, exception reports, and net pay deltas.

Why it matters: Payroll engines calculate. Payroll administrators control setup, input quality, and approval discipline.

Group payroll systems by operating reality

- SMB stacks: payroll inside accounting-led tools and payroll providers

- Enterprise stacks: HRIS-centered payroll ecosystems

This grouping reduces noise and keeps the discussion focused on process ownership, not brand repetition.

5) Manage statutory deductions, remittance, and reporting

What to do: Ensure correct withholdings and employer contributions, then track remittances and reporting confirmations.

Why it matters: Regulators care about timeliness and accuracy.

UK example: HMRC RTI

Employers submit an FPS (Full Payment Submission) to HMRC on or before payday, and they submit an EPS (Employer Payment Summary) by the 19th of the following tax month when required.

South Africa example: SARS IRP5/IT3(a)

SARS requires employers to issue an IRP5/IT3(a) when remuneration gets paid or becomes payable, and the certificate shows remuneration and employees’ tax withheld.

6) Protect payroll data with Zero Trust controls

What to do: Enforce least privilege, MFA, change logs, and controlled exports.

Why it matters: Payroll attracts fraud because it connects to pay and bank details.

NIST explains Zero Trust as a model that focuses on protecting resources and verifying access, rather than trusting a network perimeter.

What this looks like in payroll operations

- Require dual approval for pay rate changes and bank detail updates

- Verify “urgent” requests out of band

- Log every sensitive change and export

- Keep payroll files in controlled repositories, not inboxes

Watch for MFA fatigue. When people face constant prompts, they start approving without thinking. Payroll admins reduce that risk by limiting privileged actions and tightening workflows.

7) Reduce manual data latency through interoperability

What to do: Manage interoperability between time tracking, HRIS, and payroll engines through API-first integrations or controlled imports.

Why it matters: Manual rekeying creates delay and error. Interoperability reduces both.

A payroll administrator prevents “spreadsheet drift” by enforcing a single source of truth for compensation data, then pushing clean inputs into the payroll engine.

8) Close the cycle with reconciliation and finance-ready records

What to do: Reconcile payroll totals to bank outflows, export payroll journals, sync with accounting, and store evidence in a consistent structure.

Why it matters: Closeout discipline prevents month-end surprises and supports audits.

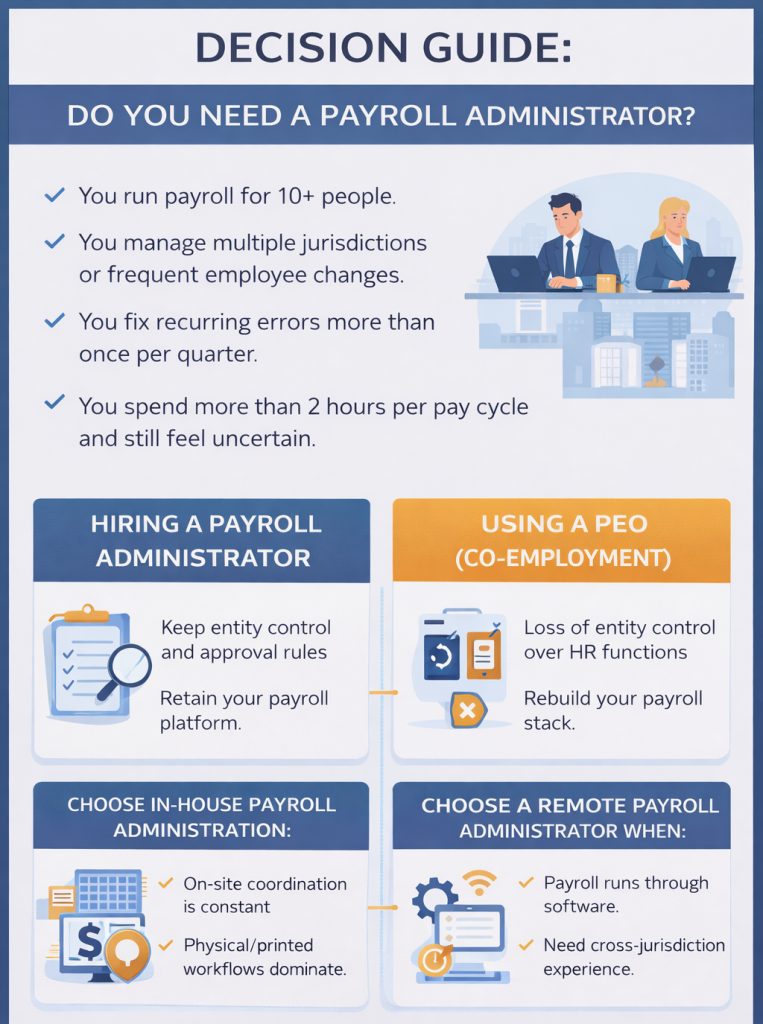

Decision guide: do you need a payroll administrator?

Use these criteria to choose DIY payroll, in-house hiring, outsourced payroll administration, or a PEO.

You likely need payroll administration support when:

- You run payroll for 10+ people and handle variable hours, overtime, bonuses, or commissions.

- You manage multiple jurisdictions or frequent employee changes.

- You fix recurring errors more than once per quarter.

- You spend more than 2 hours per pay cycle and still feel uncertain.

Payroll administrator vs. payroll officer

Some regions use “payroll officer” as a title. The scope often overlaps. Focus on responsibilities: end-to-end execution, controls, reporting, and employee support.

Payroll administrator vs. PEO

A PEO uses a co-employment model. NAPEO describes co-employment as a contractual arrangement that shares employer responsibilities between the PEO and the client.

If you want entity control, you usually prefer a payroll administrator. You keep your legal entity, your payroll stack, and your approval rules. The admin runs the workflow under your governance.

Choose in-house payroll administration when:

- You require constant on-site coordination

- Your workflow depends on physical documents and on-prem approvals

Choose a remote payroll administrator when:

- Your payroll runs through software and documented processes

- You want consistent controls without local hiring delays

- You want tighter ticket SLAs and faster reconciliations

Common mistakes and fixes

1) You treat phishing as “an IT problem”

Fix: Train payroll staff to verify bank changes through a second channel and require dual approvals for sensitive changes.

Consequence: Fraudsters target payroll teams with business email compromise tactics and payment diversion attempts.

2) You accept payroll changes through DMs and email threads

Fix: Use an intake workflow with approvals, effective dates, and stored attachments.

Consequence: You lose evidence and invite disputes.

3) You skip a defined payroll calendar

Fix: Publish cutoffs, approval owners, and escalation rules.

Consequence: Late deposits and late reporting increase penalty exposure.

4) You over-grant access inside payroll systems

Fix: Apply least privilege, MFA, and role-based permissions.

Consequence: You expand breach risk and widen the blast radius of mistakes.

5) You ignore vendor assurance signals

Fix: Request SOC 2 Type II reports from vendors that process sensitive payroll data, and align internal controls with an ISMS approach like ISO/IEC 27001. AICPA describes SOC 2 as a report on controls relevant to security, availability, processing integrity, confidentiality, or privacy.

Consequence: Security and finance teams block projects because they cannot validate risk.

6) You mishandle data residency and cross-border transfers

Fix: Document where payroll data lives, who can access it, and how transfers happen. Data residency refers to the physical location of data, which matters under privacy obligations.

Consequence: You increase legal exposure and slow down global hiring.

7) You treat garnishments like “simple deductions”

Fix: Track legal notices, calculate deductions correctly, and document remittance. ADP outlines how wage garnishments work and why employers must handle them correctly.

Consequence: You risk non-compliance and employee disputes.

8) You skip reconciliations after the pay run

Fix: Reconcile pay registers to bank outflows and accounting journals every cycle.

Consequence: Variances accumulate and explode at month-end.

9) You ignore multi-state withholding logic

Fix: Withhold based on where the employee performs services, then manage reciprocity rules where they apply. PayrollOrg notes that states generally require withholding for wages earned in the work state, even for nonresidents.

Consequence: You create tax exposure across multiple states.

Examples and mini case studies

Example 1: Founder-run payroll with repeat corrections

Situation: A 22-person services business ran payroll through spreadsheets and rushed approvals.

Action: The payroll administrator installed cutoffs, validation checks, dual approvals for pay changes, and a closeout checklist.

Outcome: The team cut correction cycles and reclaimed leadership time for operations planning.

Example 2: HR and finance split across disconnected tools

Situation: HR tracked employee changes in one system, ops tracked time elsewhere, and finance posted journals manually.

Action: The payroll administrator mapped the system of record, reduced manual data latency through controlled imports and API-first integrations, and standardized payroll journals.

Outcome: The business shortened reconciliation time and reduced month-end surprises.

Example 3: International team with reporting and privacy risk

Situation: A scale-up hired across regions and struggled with reporting obligations and access control.

Action: The payroll administrator documented data residency requirements, limited exports, enforced access logs, and tracked reporting confirmations, including employee tax certificate workflows where required.

Outcome: The business reduced privacy risk and sped up issue resolution for remote employees.

What does a payroll administrator do day to day?

A payroll administrator collects payroll inputs, validates payroll exceptions, manages payroll changes, answers employee pay questions, and maintains audit-ready payroll records each day.

What does a payroll administrator do during a pay run?

A payroll administrator enforces payroll cutoffs, reviews payroll changes, runs payroll register checks, submits payroll, confirms payroll payments, and documents payroll exceptions during a pay run.

What does “remittance” mean in payroll administration?

Remittance in payroll administration means submitting withheld taxes, statutory deductions, and required payroll payments to the correct authority or provider on time, with proof of remittance.

How do payroll administrators handle real-time reporting requirements?

Payroll administrators handle real-time reporting requirements by tracking jurisdiction-specific rules and submitting payroll reports on schedule, such as HMRC RTI filings like FPS and EPS in the UK.

What does SOC 2 Type II tell me about a payroll vendor?

SOC 2 Type II in payroll indicates that a vendor has audited controls for security, availability, processing integrity, confidentiality, or privacy, monitored over a period. It signals compliance and operational assurance.

What does ISO/IEC 27001 signal for payroll operations?

ISO/IEC 27001 in payroll operations signals that the vendor follows structured information security governance and continuous improvement under an audited information security management system (ISMS).

What should a payroll administrator never approve from email alone?

A payroll administrator should never approve bank account changes, pay rate updates, or direct deposit changes from email alone due to the risk of business email compromise attacks.

How do payroll administrators manage multi-state payroll risk in the US?

Payroll administrators manage multi-state payroll risk by withholding based on the employee’s work state and handling tax registrations and compliance rules across all states where employees perform work.

Next step

If payroll consumes your time or raises your risk, you need ownership, not another app.

Book a free consultation with Aristo Sourcing and learn how a dedicated payroll administrator can run your pay cycle, tighten compliance, improve interoperability, and protect sensitive payroll data.