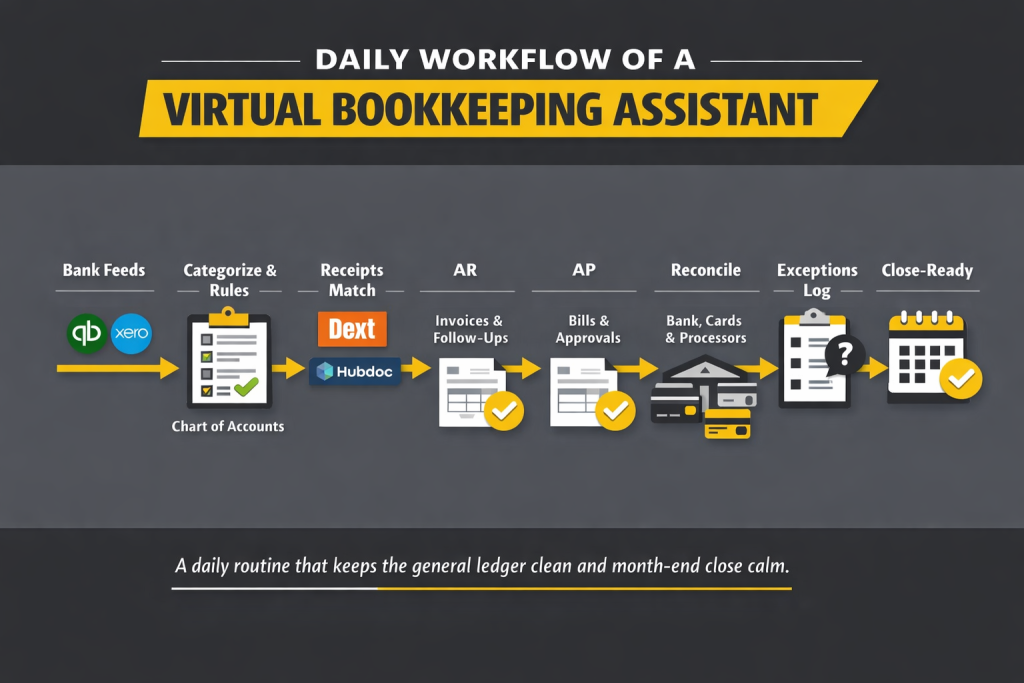

A virtual bookkeeping assistant occupies a critical middle ground between operations and accounting. They are not the accountant with fiduciary responsibility for statutory filings or tax positions, and they are not a general admin doing “a bit of finance.” Their job is to keep the general ledger trustworthy by making sure daily activity is captured, classified, and supported by evidence. Think of them as the lab tech of your finances: they run the tests, document results, and flag anomalies before they become expensive surprises.

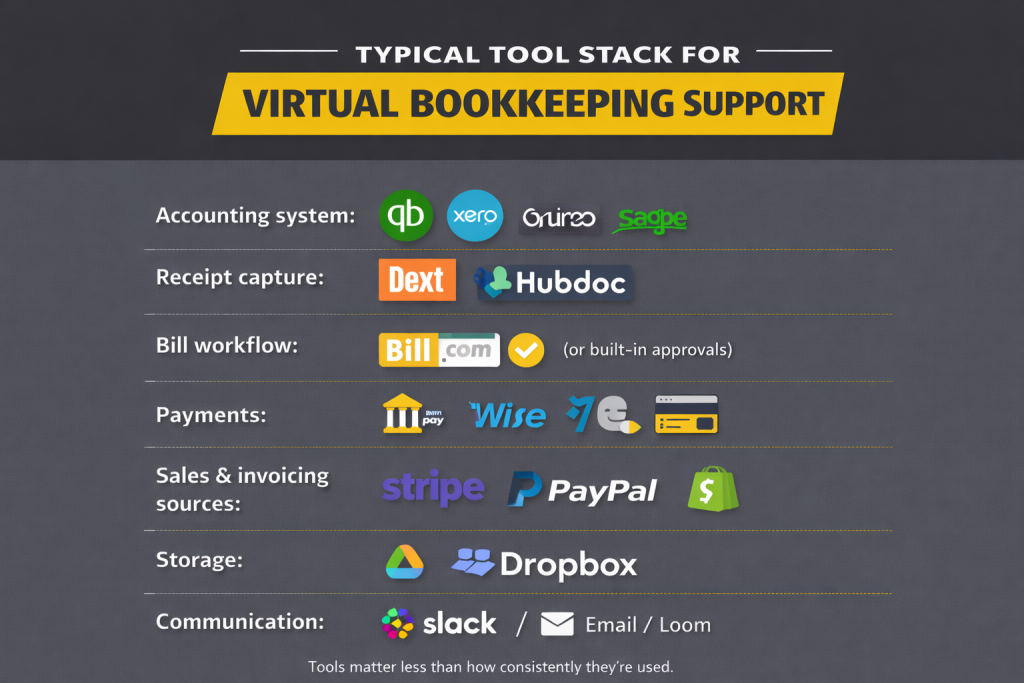

That role matters because modern businesses create transactions everywhere. Money moves through bank accounts, credit cards, Stripe, PayPal, Shopify, Amazon, payroll platforms, and expense apps, often with imperfect integrations. If those feeds do not reconcile into one coherent chart of accounts, you end up with reports that look official but behave like guesswork. The daily work is not “more bookkeeping,” it is data hygiene that protects decision-making.

Daily cash flow management: why VAs start with bank feeds

Most days start with the bank feed because it is the closest thing to the truth. In QuickBooks Online or Xero, a bookkeeping assistant reviews new bank and credit card transactions, checks whether they are auto-matched, and investigates anything that looks wrong. They look for duplicate imports, missing payouts, transfers coded as expenses, and fee lines that distort margins. They also compare bank activity to operational context, because a deposit without a matching invoice is not “income,” it is an unanswered question.

This is where reconciliations begin long before month-end. The assistant ensures the bank feed reflects reality by resolving items while details are fresh and stakeholders remember what happened. They do not have to “do accounting,” but they must understand how bank activity maps into the general ledger and where it can break. If you want a simple diagnostic question: Could you explain yesterday’s cash movement in 10 minutes without hand-waving? If not, the bank feed is not a convenience feature, it is your first daily control point.

Expense categorization and chart of accounts maintenance

Categorization is one of the most misunderstood daily tasks. It is easy to treat it like data entry, but classification drives reporting, and reporting drives decisions. The assistant applies consistent rules to expenses so the profit and loss tells the same story every month, rather than changing based on who coded it that day. They also maintain the chart of accounts, keeping it usable instead of letting it turn into a junk drawer of near-duplicate categories.

A practical example shows why this matters. A SaaS business might code “contractors” as a single bucket, but separating product development contractors from marketing contractors can change how you interpret retention spend and growth efficiency. A virtual bookkeeping assistant escalates those classification choices to the owner or accountant, then documents the policy so it stays consistent. Over time, this creates financial integrity because the general ledger stops being a diary and becomes a system.

Receipts and documentation: moving to proactive digital capture

Receipts are not about tidiness, they are about evidence. Without documentation, reimbursements become disputes, VAT or sales tax support becomes weak, and expense claims become hard to audit. A good assistant runs a daily receipt workflow using tools like Dext, Hubdoc, Expensify, or even a structured Google Drive intake process. They match receipts to transactions, standardize naming, and chase missing documents while the buyer still remembers what they purchased.

This is also where process design beats heroic effort. Instead of reactive paper-chasing, the assistant sets expectations: what must be uploaded, where it goes, and when it is due. They create a simple rule like “no receipt, no reimbursement,” then make it easy to comply. Ask yourself a hard question: If a lender asked for support for your top 20 expense lines, would you produce it confidently? That is what daily documentation is really protecting.

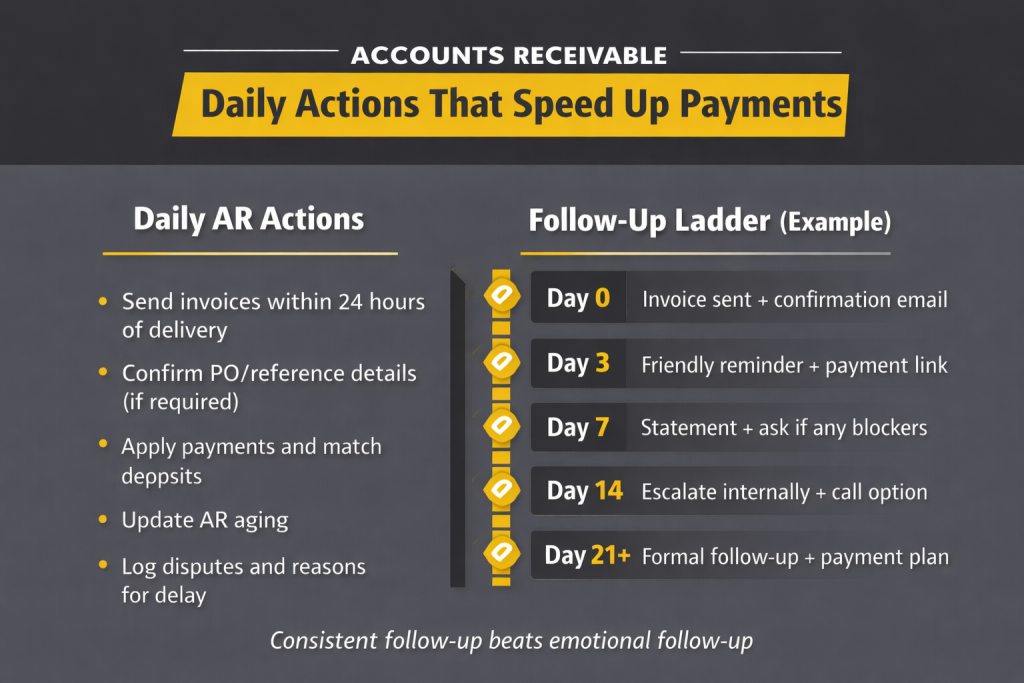

Accounts receivable: invoicing, AR aging, and getting paid

Accounts receivable is the daily work that most directly affects cash. The assistant ensures invoices go out on time, with correct line items, tax treatment, and purchase order references where needed. They monitor AR aging and run follow-ups on a defined cadence, so reminders are consistent rather than emotional. They also track disputes and reasons for non-payment, because many “late payers” are actually “confused payers.”

Late payment is not a niche issue, and you do not need to be a finance nerd to feel its impact. FreeAgent reported that almost two-thirds of invoices sent by UK small businesses in the past year were paid late. That statistic changes how you frame AR, because late payments are not an exception, they are a predictable risk. A virtual bookkeeping assistant reduces that risk by tightening invoice hygiene, maintaining a follow-up sequence, and escalating issues with evidence rather than frustration.

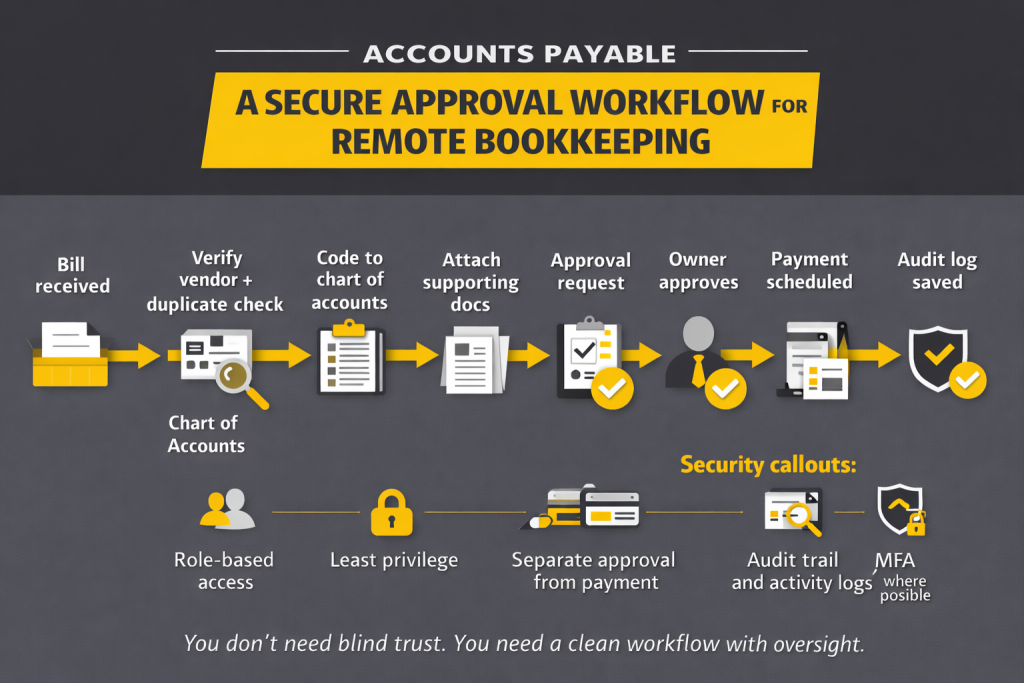

Accounts payable: bills, approvals, and vendor oversight

Accounts payable is the most common security concern for founders, and the right answer is workflow design. The assistant collects bills, verifies vendor details, checks for duplicates, codes expenses correctly, and routes them for approval. They can run this inside QuickBooks, Xero, or Sage, often paired with tools like Bill com for approvals and payment scheduling. The assistant does not need full control of payments to make AP run smoothly, because the approval chain and bank permissions can remain with the owner.

They also protect the business from silent leakage. Subscriptions renew, vendors keep billing, and teams forget what tools were purchased for which purpose. A solid VA maintains a vendor list, flags recurring charges that no longer have an owner, and ensures credits are applied. Consider this question: Which three vendors could stop billing tomorrow without anyone noticing for 60 days? If you cannot answer, AP oversight is not “finance admin,” it is operational governance.

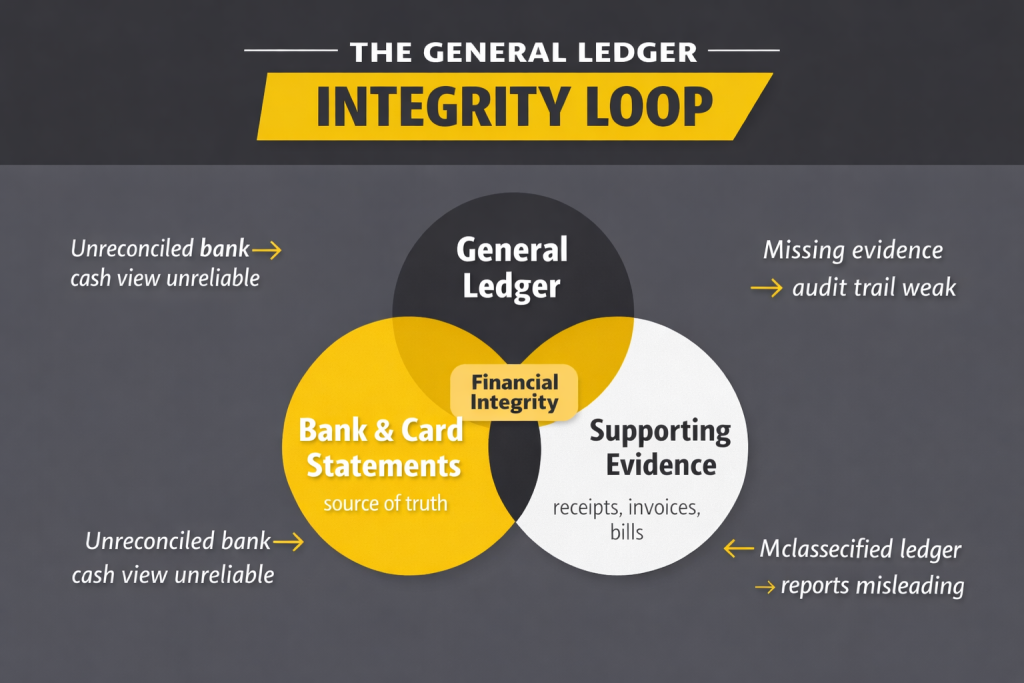

Reconciliations: keeping the general ledger honest

Reconciliation is where bookkeeping becomes non-negotiable. Matching the bank statement to the books confirms that what you recorded is what actually happened, and it exposes missing transactions or misclassifications. In modern stacks, reconciliations also involve payment processors, payroll journals, and clearing accounts, not just the bank. The assistant checks that deposits match payout reports and that fees are recorded properly, so revenue is not overstated.

This work can be a major time sink when done late or done manually. A 2025 benchmark summary reported that average time spent on cash reconciliation can be 20 to 50 hours per month, and that many teams use 3 to 5 systems to complete it. One finance leader quoted in coverage of that survey said teams sometimes “spend more time trying to explain the mismatches than actually fixing them.” A virtual bookkeeping assistant earns their place by reducing mismatches upstream, then documenting exceptions so the accountant can review rather than re-investigate.

Journal entries and adjusting entries: what belongs daily vs month-end

Owners often hear “journal entries” and assume it is accountant-only territory. In reality, there is a clean division: bookkeeping assistants can prepare support and drafts, while an accountant reviews and posts higher-risk adjustments. Daily, the assistant identifies transactions that need reclassifying, tracks prepaid expenses, and ensures payroll entries land in the correct accounts. They may also prepare schedules for accruals, deferrals, and fixed asset additions, which the accountant can turn into adjusting entries.

This is not about playing accountant, it is about being close-ready. If an assistant flags that insurance was paid annually but coded as a monthly expense, they prevent misleading financials. If they track deposits as liabilities until earned, they protect revenue recognition logic. These are small moves with big reporting consequences because they keep the general ledger aligned to the business reality. The question to debate is simple: Do you want accuracy by luck, or accuracy by design?

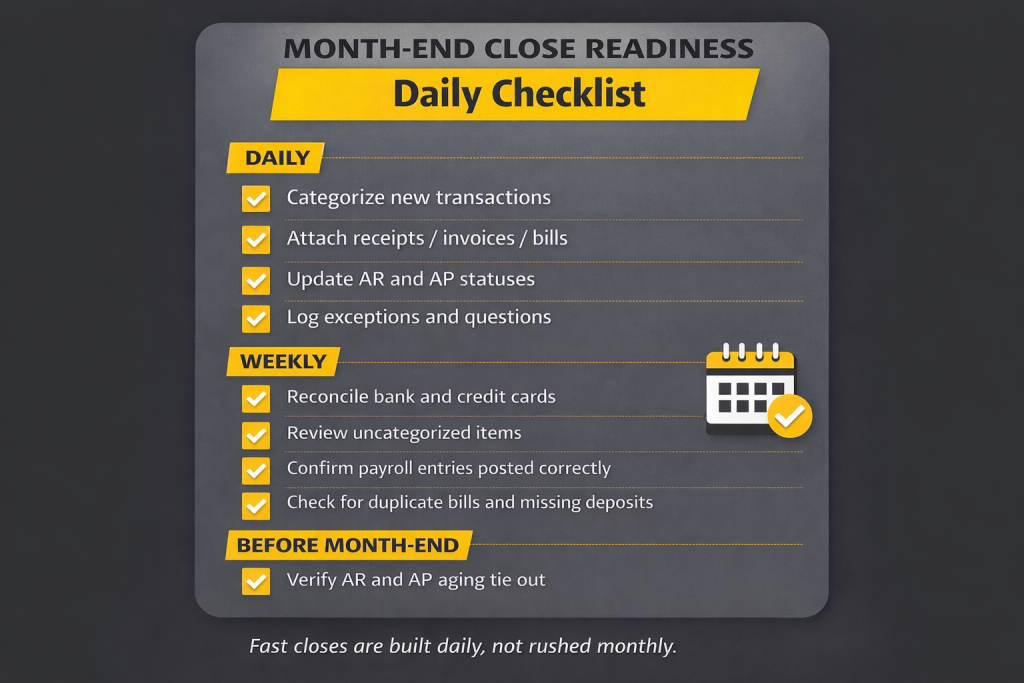

Month-end close preparation: building a fast close from daily habits

Month-end close is not a calendar event, it is the sum of daily discipline. The assistant ensures transactions are categorized, documentation is attached, and reconciliations are up to date. They prepare AR and AP aging, confirm balance sheet accounts reconcile, and compile a short exceptions log. This package gives the owner and accountant a clear view of what needs decisions versus what is already clean.

Close speed has real benchmarks, and it is a useful proxy for financial maturity. Ventana Research material on the close process notes that only 53% of companies complete their monthly close within six business days. Faster close cycles correlate with timely information, which is the entire point of doing this work well. A virtual bookkeeping assistant helps you get closer to that standard by turning “end of month panic” into “end of month review,” which is the difference between reporting and a rescue mission.

Reporting and stakeholder communication: turning numbers into action

A virtual bookkeeping assistant should not dump reports into your inbox and vanish. They provide short, decision-oriented updates: overdue invoices, upcoming payables, anomalies in spend, and any categorization questions that affect reporting. They generate routine reports like profit and loss, balance sheet, and cash flow summaries, but they also add context like “merchant fees increased due to higher refund volume” or “ad spend looks high because an annual contract hit this week.” That context is what stops leadership meetings from turning into forensic accounting.

This is also where the role supports other teams. Sales wants clean AR status, operations wants vendor predictability, and leadership wants confidence in margin and runway. The assistant becomes the “single source of truth wrangler,” making sure data from tools like QuickBooks, Xero, or Sage reflects what the business actually did. If you want one more debate question: Do your teams trust your numbers enough to act quickly, or do they wait for someone to validate them? Trust is built through daily consistency, not monthly heroics.

The real takeaway: what the best VAs protect

When this role is done well, it protects three things: financial integrity, operational rhythm, and management focus. Financial integrity comes from clean reconciliations, documented transactions, and consistent chart-of-accounts logic. Operational rhythm comes from dependable AR and AP workflows that reduce surprises and stabilize cash movement. Management focus comes from removing daily finance friction, so founders and leaders can work on growth rather than triage. But, how much does it cost you each month to run a business without reliable financial visibility?