Your CRM is the nervous system of your brokerage. When optimized, it works as a referral engine. When ignored, it becomes a graveyard of expensive leads. Scaling past five loans a month requires a shift from broker‑led follow‑up to process‑led execution, powered by a trained mortgage VA.

Most brokers don’t hit a ceiling because of market conditions. They stall because their operational hub cannot support volume, delegation, or compliance at the same time. This guide explains which systems actually support remote teams, how virtual assistants run them day to day, and how brokers reclaim high‑value hours without increasing risk.

Key Takeaways

- The best mortgage CRMs function as pipeline management software, not contact lists.

- Jungo, BNTouch, and Whiteboard CRM support remote execution in different ways.

- A VA protects pipeline velocity by enforcing follow‑ups, conditions chasing, and data hygiene.

- Proper role design prevents licensing and compliance violations.

- CRM performance improves only when tied to SOPs, access control, and metrics.

Why This Matters Now

High‑producing solo brokers, small boutiques, and referral‑driven teams all face the same constraint: time. Every hour spent chasing bank statements or updating statuses carries an opportunity cost. When that work piles up, files slow down, agents disengage, and compliance exposure grows.

Remote support solves the labor problem, but only if the system of record supports delegation. A strong client relationship tool allows non‑licensed staff to handle the administrative 80 percent of the workflow while the broker protects the licensed 20 percent. That separation now determines whether a brokerage grows or stalls.

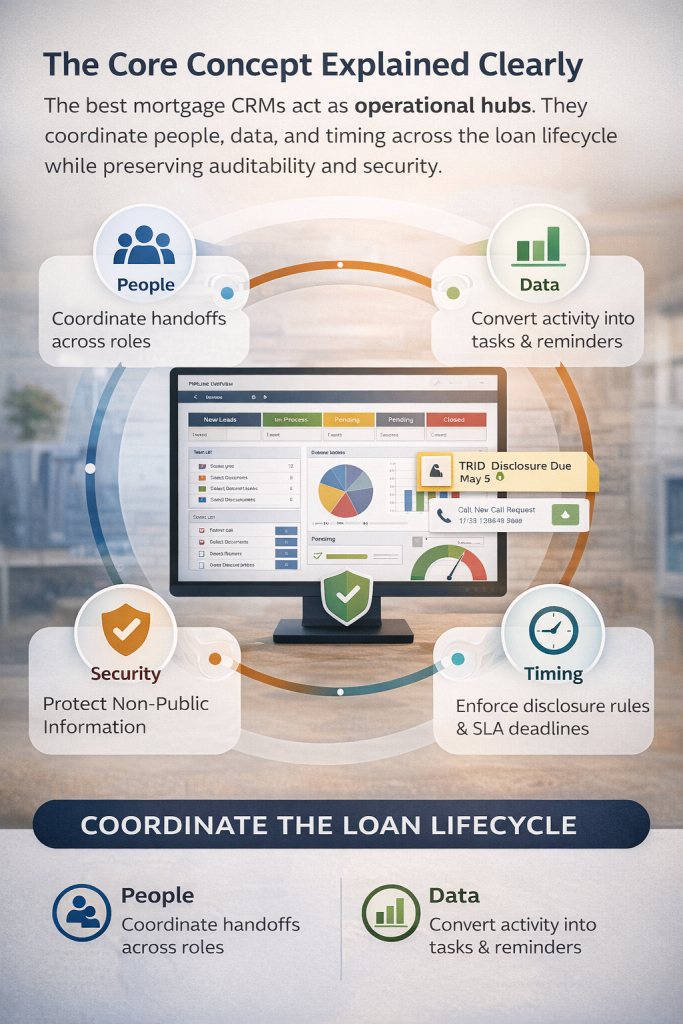

The Core Concept Explained Clearly

The best mortgage CRMs act as operational hubs. They coordinate people, data, and timing across the loan lifecycle while preserving auditability and security.

How These Systems Actually Create Leverage

- Automate the lead‑to‑contract transition by triggering notifications the moment a 1003 starts.

- Convert borrower activity into tasks, reminders, and status changes without manual chasing.

- Enforce disclosure timelines tied to TRID and internal SLAs.

- Maintain clean records for NMLS compliance and Mortgage Call Reports.

- Protect Non‑Public Information through role‑based access and masking.

Where Brokers Go Wrong

Many brokers treat their CRM as storage instead of execution. Leads sit untouched. Follow‑ups rely on memory. VAs receive broad access with no guardrails. Over time, the system degrades into noise instead of clarity.

A CRM only creates value when it drives behavior through process design.

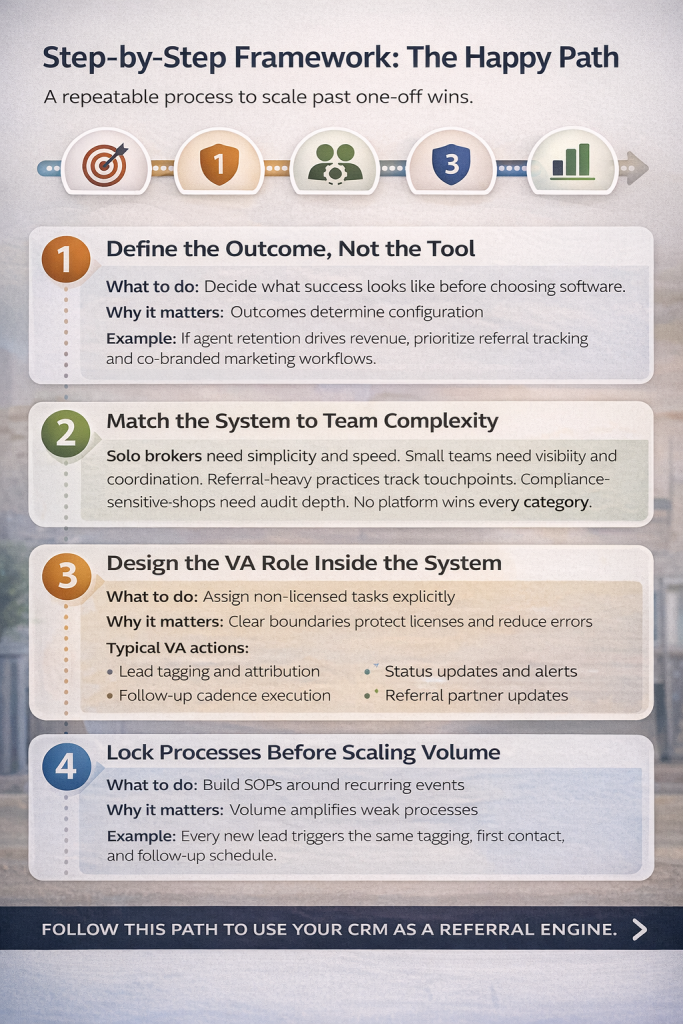

Step‑by‑Step Framework: The Happy Path

1. Define the Outcome, Not the Tool

What to do: Decide what success looks like before choosing software.

Why it matters: Outcomes determine configuration.

Example: If agent retention drives revenue, prioritize referral tracking and co‑branded marketing workflows.

2. Match the System to Team Complexity

Solo brokers need simplicity and speed. Small teams need visibility and coordination. Referral‑heavy practices need touchpoint tracking. Compliance‑sensitive shops need audit depth. No platform wins every category.

3. Design the VA Role Inside the System

What to do: Assign non‑licensed tasks explicitly.

Why it matters: Clear boundaries protect licenses and reduce errors.

Typical VA actions:

- Lead tagging and attribution

- Follow‑up cadence execution

- Document labeling and filing

- Status updates and alerts

- Referral partner updates

4. Lock Processes Before Scaling Volume

What to do: Build SOPs around recurring events.

Why it matters: Volume amplifies weak processes.

Example: Every new lead triggers the same tagging, first contact, and follow‑up schedule.

5. Measure What Moves Files Forward

Track:

- Time to first contact

- Lead aging by stage

- Conditions outstanding

- Tasks completed per day

- Referral touchpoint frequency

Metrics turn intuition into management.

Decision Guide: Tools, Integrations, Advantage

| Use Case | Recommended Tool | Integrations | VA Advantage |

|---|---|---|---|

| High‑volume scaling | Jungo | Salesforce, Calyx, MeridianLink | VA manages complex lead attribution and pipeline reporting |

| Multi‑channel marketing | BNTouch | Email, SMS, LOS sync | VA runs automated campaigns and monitors pull‑through |

| Realtor relationship focus | Whiteboard CRM | Agent portals, email | VA executes Friday updates and co‑branded touchpoints |

| Compliance‑heavy states | Any secure system | Floify, secure doc portals | VA works within strict permission and audit frameworks |

Common Edge‑Case Mistakes and Fixes

- The CRM fills up but nothing moves.

Fix: Tie every stage change to a task or notification.

If ignored: Leads decay silently. - VAs see more data than they should.

Fix: Enforce role‑based access and NPI masking.

If ignored: Compliance exposure increases. - Follow‑ups depend on memory.

Fix: Use automated sequences and alerts.

If ignored: Referral partners disengage. - Integrations remain unused.

Fix: Connect LOS, document portals, and email.

If ignored: Duplicate work and errors multiply. - The broker still does admin work.

Fix: Reassign tasks weekly based on reports.

If ignored: Growth stalls at the same ceiling.

Examples from the Field

Solo Broker Scaling Without Hiring Locally

A solo broker closing six loans per month used Jungo with no delegation. After assigning a VA to run lead follow‑ups and condition reminders, time to first contact dropped below 20 minutes. Closings increased to nine per month without adding office staff.

Boutique Agency Protecting Referrals

A four‑broker shop relied on ad hoc updates to agents. By using Whiteboard CRM with a VA executing structured Friday updates, referral response rates improved and agent churn dropped within one quarter.

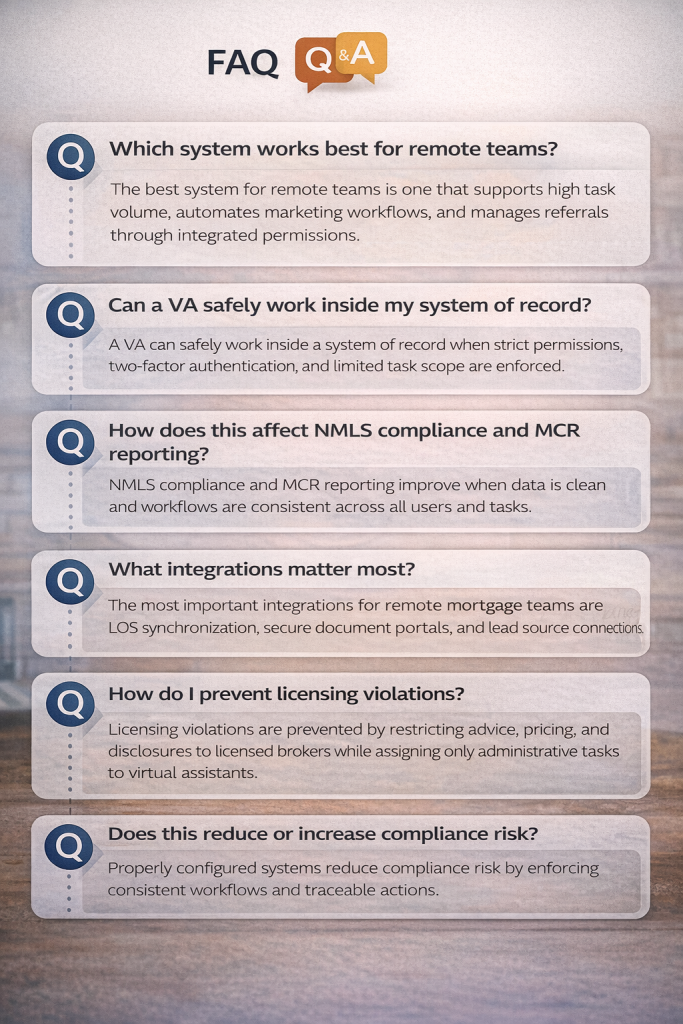

Which system works best for remote teams?

The best system for remote teams is one that supports high task volume, automates marketing workflows, and manages referrals through integrated permissions.

Can a VA safely work inside my system of record?

A VA can safely work inside a system of record when strict permissions, two‑factor authentication, and limited task scope are enforced.

How does this affect NMLS compliance and MCR reporting?

NMLS compliance and MCR reporting improve when data is clean and workflows are consistent across all users and tasks.

What integrations matter most?

The most important integrations for remote mortgage teams are LOS synchronization, secure document portals, and lead source connections.

How do I prevent licensing violations?

Licensing violations are prevented by restricting advice, pricing, and disclosures to licensed brokers while assigning only administrative tasks to virtual assistants.

Does this reduce or increase compliance risk?

Properly configured systems reduce compliance risk by enforcing consistent workflows and traceable actions.

Next Step

If you close five or more loans per month and still handle follow‑ups yourself, your system limits your growth. The fastest way forward pairs the right platform with a VA trained to run it.

Start by using the virtual assistant calculator to see how many high‑value hours you lose each week, then book a free consultation to design a VA‑ready workflow that scales without adding stress.